Egypt Supports Freelancing with a Strategic Vision and Executive Steps to Boost the Digital Economy

Amid the push for digital transformation and empowering youth, Egypt has adopted an integrated strategy to support freelancing and entrepreneurship.

This includes providing infrastructure, training, and tax incentives, contributing to the creation of new job opportunities and enhancing the competitiveness of the Egyptian economy.

Significant Growth in Freelancers

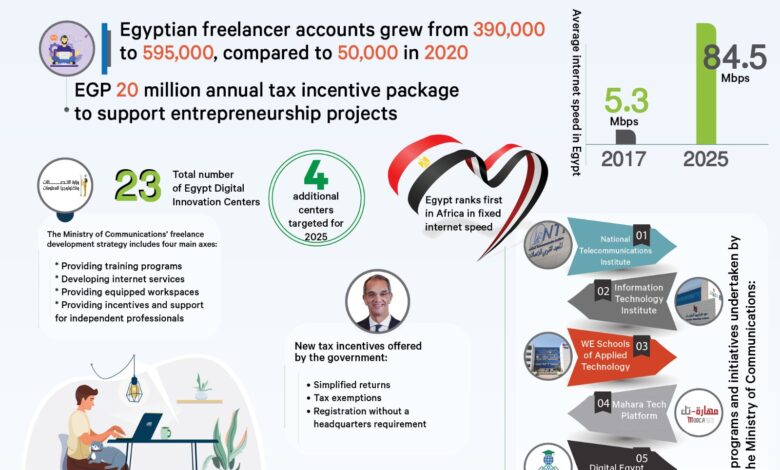

Egypt has witnessed a surge in the number of freelancer accounts, rising from 50,000 accounts in 2020 to 390,000 accounts, and now reaching 595,000 accounts. This reflects the growing demand for this type of work in line with the rapid digitization trend.

20 Million EGP Annual Incentives for Entrepreneurship

The government offers a package of facilities and tax incentives worth 20 million EGP annually, aimed at encouraging emerging businesses and supporting the entrepreneurial ecosystem, particularly in the digital and technological services sectors.

Notable Improvement in Internet Speed and Infrastructure Development

The average internet speed in Egypt has risen from 5.3 Mbps in 2017 to an expected speed of 84.5 Mbps by 2025, positioning Egypt as a leader in fixed internet speed across Africa.

Expansion of Digital Egypt Creativity Centers

The number of Digital Egypt Creativity Centers has reached 23 centers so far, with plans to add 4 new centers during 2025. These centers are designed to provide a supportive work environment for youth and entrepreneurs in various governorates.

Freelancing Strategy at the Ministry of Communications

The freelancing development strategy includes four main pillars:

- Providing training and qualification programs.

- Enhancing internet services and digital infrastructure.

- Providing equipped workspaces.

- Offering financial and professional incentives to freelancers.

Various Training Programs and Initiatives

The Ministry of Communications has launched several training programs and initiatives, most notably:

- National Telecommunications Institute

- Information Technology Institute

- WE Schools for Applied Technology

- “Maharat Tech” Platform

- “Digital Egypt Pioneers” Initiative

- “ITIDA Gigs” Initiative

Tax Incentives to Encourage Freelancing and Service Export

The new tax incentives include:

- Simplified declarations

- Tax exemptions

- Tax registration without the need for a physical office

Additionally, the government is considering offering incentives for the first 100,000 new taxpayers who register for the first time.